FinOps is a cultural practice at its core. It’s the way for teams to manage and optimize technology value, where everyone takes ownership of their cost and usage supported by a central best-practices group. Cross-functional teams in Engineering, Finance, Product, etc. work together to enable faster product delivery, while at the same time gaining more financial control and predictability, enabling stronger Executive decision making.

FinOps is a portmanteau of “Finance” and “DevOps”, stressing the communications and collaboration between business and engineering teams.

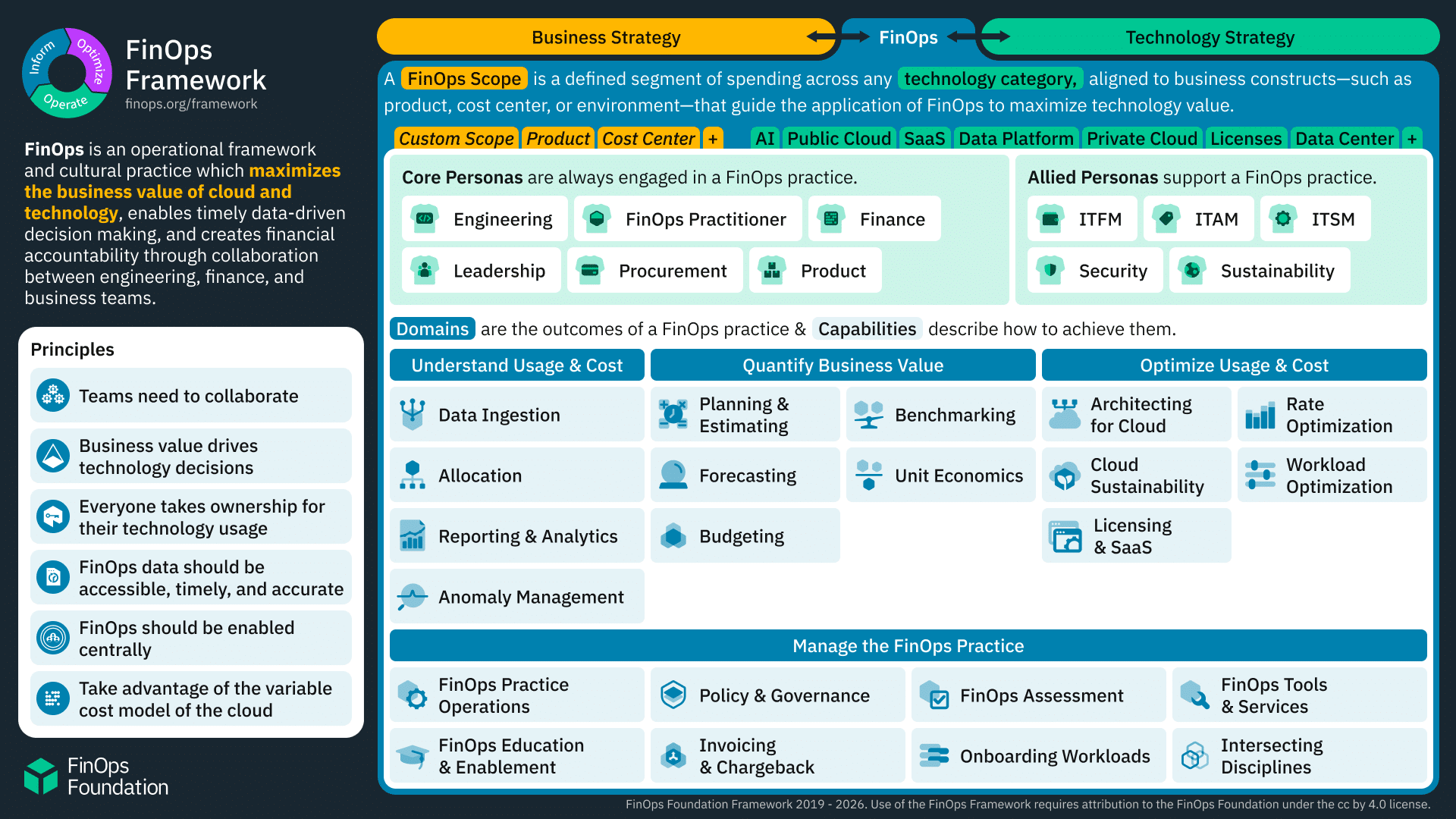

Other names for the practice include “Cloud Financial Management”, “Cloud Financial Engineering” “Cloud Cost Management”, “Cloud Optimization”, or “Cloud Financial Optimization”. FinOps has a strong heritage in managing cloud cost and usage, but that focus expands as modern FinOps practices encompass managing spend across all types of technology categories, such as SaaS, Licensing, Data Center, Data Cloud Platforms, and more.

FinOps is sometimes incorrectly referred to “Cloud Financial Operations”, but that term is falling out of favor due to its ambiguity with the more traditional “Financial Operations” role that exists in Finance.

Regardless of the name, FinOps is the practice of bringing a financial accountability cultural change to how technology value is measured across categories like Cloud, SaaS, PaaS, Licensing, Data Centers, Data Cloud Platforms, and more. It enables distributed engineering and business teams to make trade-offs between speed, cost, and quality in their architecture and investment decisions.

The goal: identify, communicate, and optimize the value behind technology decisions to support business and technology objectives.

If it seems that FinOps is about saving money, think again. FinOps is about getting the most value out of technology to drive efficient growth.

Strategic technology investments can drive more revenue, signal customer base growth, enable more product and feature release velocity, or even refine and streamline the entire IT estate. FinOps is all about removing blockers against these valuable initiatives; empowering engineering teams to deliver better features, apps, and migrations faster; and enabling a cross-functional conversation about where to invest and when into a variety of technologies. Sometimes a business will decide to tighten the belt; sometimes it’ll decide to invest more. But now teams know which of their technology investments return the most value and can make better, confident decisions into the future.

How to Start Learning FinOps

The FinOps Foundation offers a variety of ways to learn about the discipline, depending on your familiarity and time commitment. Newer Practitioners find the most success with the following:

- Take the Intro to FinOps course (free): Use this free, self-paced course to familiarize yourself and your team with FinOps.

- Become a FinOps Certified Practitioner: Take this self-paced course and exam, frequently updated to reflect the latest best practices to help you start your FinOps career.

- Attend an upcoming FinOps Event: Meet and learn from like-minded practitioners and experts in welcoming, inclusive environments (both regional and virtual) designed to connect people and inspire new ideas.

Supplement your self-paced learning by familiarizing yourself with the FinOps Framework, and check out FinOps Assets from our Working Groups, including Papers and Playbooks to help inform, empower, and expand your practice.

Watch Videos on Our Educational YouTube Channel

Check out our monthly Virtual Summits and practitioner presentations and our FinOps X Session Library to catch up on a variety of FinOps Capabilities and Topics, and see how other global practitioners are advancing their practice.

Ready to Adopt FinOps?

Check out our Adopting FinOps asset that includes step-by-step descriptions on how to get started, as well as Intro to FinOps slides in Google Slides or Powerpoint. Benchmark and compare your organization’s progress against our annual industry snapshot, the State of FinOps.

FinOps Framework: Maximizing the Business Value of Technology

FinOps Principles

FinOps Principles create financial accountability through collaboration and drive business value for technology spend.

Stakeholder Personas

While a central FinOps function may work to enable organizational change, FinOps is not done by a single person or team but rather changes the way that disparate engineering, finance, and business teams work together. Individuals at every level and in every area of an organization can have a different role to play in the FinOps practice: Executives, Engineers, FinOps Practitioners, Operations, Finance and Procurement.

Read more about FinOps Personas and Roles.

Maturity Model

The practice of FinOps is inherently iterative and maturity of any given process, functional activity, Capability or Domain will improve with repetition. Typically a “Crawl” stage organization is highly reactive and focused on addressing problems after they occur, while a Run stage practice is proactively factoring cost into their architecture design choices and ongoing engineering processes.

A “Crawl, Walk, Run” maturity approach to performing FinOps enables organizations to start small, and grow in scale, scope and complexity as business value warrants maturing a functional activity. Taking quick action at a small scale and limited scope allows FinOps teams to assess the outcomes of their actions, and to gain insights into the value of taking further action in a larger, faster, or more granular way.

Learn more about FinOps Maturity in the FinOps Framework.

FinOps Scopes

FinOps Scopes establish the decision context and a shared reference to align stakeholders, activities, and outcomes within a FinOps practice. This context enables the development of practice profiles that determine which Personas are engaged, which Capabilities are applied, and which Domains define success.

Learn more about FinOps Scopes.

FOCUS: The Unifying Language for Technology Value

The FinOps Foundation supports the development of an open-source technical specification for technology billing data. The FinOps Open Cost and Usage Specification (FOCUS™), defines a unified format for data providers to produce consistent billing datasets. FOCUS enables FinOps Practitioners to more easily unlock data-driven decision-making and maximize the business value of their technologies, while making their skills more transferable across clouds, tools, and organizations.

The largest cloud service providers – Microsoft Azure, Google Cloud, Oracle Cloud Infrastructure (OCI), and Amazon Web Services (AWS) – all offer FOCUS-formatted cost and usage billing data exports directly from their native consoles. SaaS providers, like Databricks, Grafana, and more, join in this effort to unify how consumption-based billing data is exported and analyzed by FinOps practitioners. Several FinOps tooling vendors also support FOCUS data and generate reports using FOCUS attributes and metrics.

FinOps Practitioners can learn more about how to obtain FOCUS data from their data generators.